Option valuation

Option valuation

On this page you can download a tool to calculate and chart the behaviour of vanilla and exotic European options.

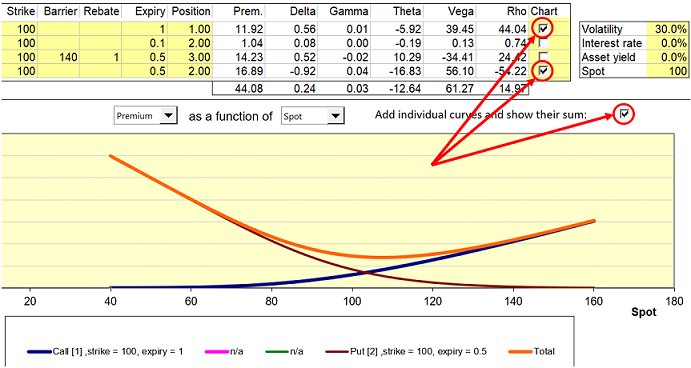

The illustration shows the tool analysing a European Call and a Digital Call option.

The following sections explain how to use the utility.

Inputs

The cells you can change (i.e. the "input" cells) are marked with a light yellow background.

On each of the top four rows you can specify a vanilla or exotic option.

You can select which "greek" you want to chart (e.g. Delta, Gamma). You can also choose the horizontal axis variable. It can be one of three: 1) The underlying spot / market price varies, 2) Volatility varies, or 3) Time varies.

In the example we have chosen to chart premium on the vertical axis and spot or market on the horizontal axis.

Charts

Click on a checkbox in the "Chart" column to display the corresponding chart. To also chart the total / portfolio position click the checkbox titled "Add individual curves and show their sum".

Option types

The types of options you can define are listed next.

Call Option, Put Option

Contract details that must be defined are:

- Strike

- Expiry (in years), and

- Position (number of options)

Rate details that must be defined are:

- Spot

- Volatility

- Interest rate, and

- Asset yield

Asset

This refers to the asset underlying the option. The only contract detail required is the Position - the number of assets held.

Cash

This refers to cash. The only contract detail required is the Position - the number of dollars (or other currency) held.

Call digital, Put digital

This is a digital call or put option that pays off if the option is in the money at expiry. The contract details required are: Strike, Expiry and Position.

The option is assumed to pay $1 if it expires in the money. If you require some other payoff then use the Position field to scale the payoff. For example if the option should pay $10 then set the position to 10.

Call up and out, call down and out, put up and out, put down and out

These are "out" barrier options. Contract details required are: Strike, barrier, expiry and position. Additionally you can set a rebate. The rebate is paid if the option knocks out. The rebate is paid at knockout.

Call up and in, call down and in, put up and in, put down and in

These are "in" barrier options. Contract details required are: Strike, barrier, expiry and position. Additionally you can set a rebate. The rebate is paid if the option doesn't knock in. The rebate is paid at expiry (if the option hasn't knocked in by that time).